Transforming Data (R)

Red means that the page does not exist yet

Gray means that the page doesn’t yet have separation of different levels of understanding

Orange means that the page is started

In this website you can choose to expand or shrink the page to match the level of understanding you want.

- If you do not expand any (green) subsections then you will only see the most superficial level of description about the statistics. If you expand the green subsections you will get details that are required to complete the tests, but perhaps not all the explanations for why the statistics work.

- If you expand the blue subsections you will also see some explanations that will give you a more complete understanding. If you are completing MSc-level statistics you would be expected to understand all the blue subsections.

- Red subsections will go deeper than what is expected at MSc level, such as testing higher level concepts.

A lot of analyses is dependent on data being normally distributed. One problem with your data might be that it is skewed. Lets focus on the gapminder data from 2007 to see if the gdp and life expectancy data is skewed, and how this could be addressed.

library(gapminder)

library(ggplot2)

# create a new data frame that only focuses on data from 2007

gapminder_2007 <- subset(

gapminder, # the data set

year == 2007

)

# Skewness and kurtosis and their standard errors as implement by SPSS

#

# Reference: pp 451-452 of

# http://support.spss.com/ProductsExt/SPSS/Documentation/Manuals/16.0/SPSS 16.0 Algorithms.pdf

#

# See also: Suggestion for Using Powerful and Informative Tests of Normality,

# Ralph B. D'Agostino, Albert Belanger, Ralph B. D'Agostino, Jr.,

# The American Statistician, Vol. 44, No. 4 (Nov., 1990), pp. 316-321

spssSkewKurtosis=function(x) {

w=length(x)

m1=mean(x)

m2=sum((x-m1)^2)

m3=sum((x-m1)^3)

m4=sum((x-m1)^4)

s1=sd(x)

skew=w*m3/(w-1)/(w-2)/s1^3

sdskew=sqrt( 6*w*(w-1) / ((w-2)*(w+1)*(w+3)) )

kurtosis=(w*(w+1)*m4 - 3*m2^2*(w-1)) / ((w-1)*(w-2)*(w-3)*s1^4)

sdkurtosis=sqrt( 4*(w^2-1) * sdskew^2 / ((w-3)*(w+5)) )

## z-scores added by reading-psych

zskew = skew/sdskew

zkurtosis = kurtosis/sdkurtosis

mat=matrix(c(skew,kurtosis, sdskew,sdkurtosis, zskew, zkurtosis), 2,

dimnames=list(c("skew","kurtosis"), c("estimate","se","zScore")))

return(mat)

}

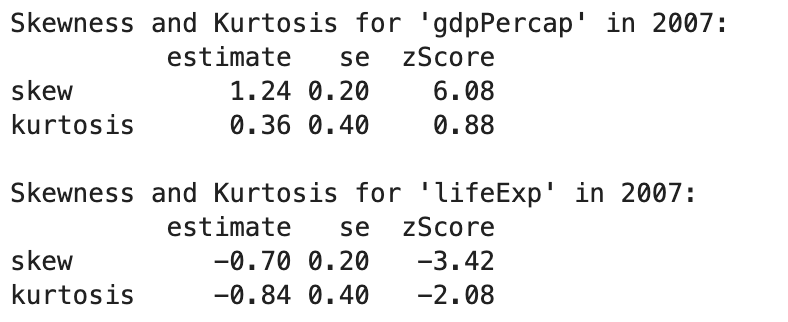

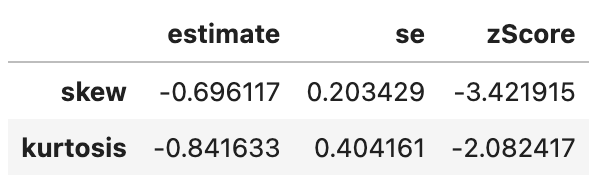

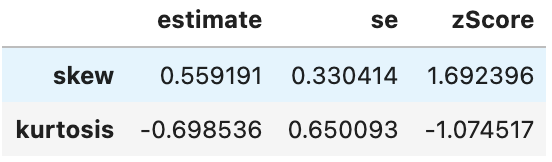

spssSkewKurtosis(gapminder_2007$gdpPercap) estimate se zScore

skew 1.2241977 0.2034292 6.0178067

kurtosis 0.3500942 0.4041614 0.8662238spssSkewKurtosis(gapminder_2007$lifeExp) estimate se zScore

skew -0.6887771 0.2034292 -3.385832

kurtosis -0.8298204 0.4041614 -2.053191import pandas as pd

import numpy as np

from gapminder import gapminder

# Filter data for the year 2007

gapminder_2007 = gapminder.loc[gapminder['year'] == 2007]

# Define a function to calculate skewness and kurtosis with their standard errors

def spssSkewKurtosis(x):

w = len(x)

m1 = np.mean(x)

m2 = np.sum((x - m1) ** 2)

m3 = np.sum((x - m1) ** 3)

m4 = np.sum((x - m1) ** 4)

s1 = np.std(x)

skew = (w * m3 / ((w - 1) * (w - 2)) / s1 ** 3)

sdskew = np.sqrt(6 * w * (w - 1) / ((w - 2) * (w + 1) * (w + 3)))

kurtosis = (w * (w + 1) * m4 - 3 * m2 ** 2 * (w - 1)) / ((w - 1) * (w - 2) * (w - 3) * s1 ** 4)

sdkurtosis = np.sqrt(4 * (w ** 2 - 1) * sdskew ** 2 / ((w - 3) * (w + 5)))

# Calculate z-scores

zskew = skew / sdskew

zkurtosis = kurtosis / sdkurtosis

# Create a DataFrame for the results

result_df = pd.DataFrame({

"estimate": [skew, kurtosis],

"se": [sdskew, sdkurtosis],

"zScore": [zskew, zkurtosis]

}, index=["skew", "kurtosis"])

return result_df

# Calculate skewness and kurtosis for 'gdpPercap' and 'lifeExp' in 2007

gdpPercap_results = spssSkewKurtosis(gapminder_2007['gdpPercap'])

lifeExp_results = spssSkewKurtosis(gapminder_2007['lifeExp'])

print("Skewness and Kurtosis for 'gdpPercap' in 2007:")

print(gdpPercap_results)

print("\nSkewness and Kurtosis for 'lifeExp' in 2007:")

print(lifeExp_results)

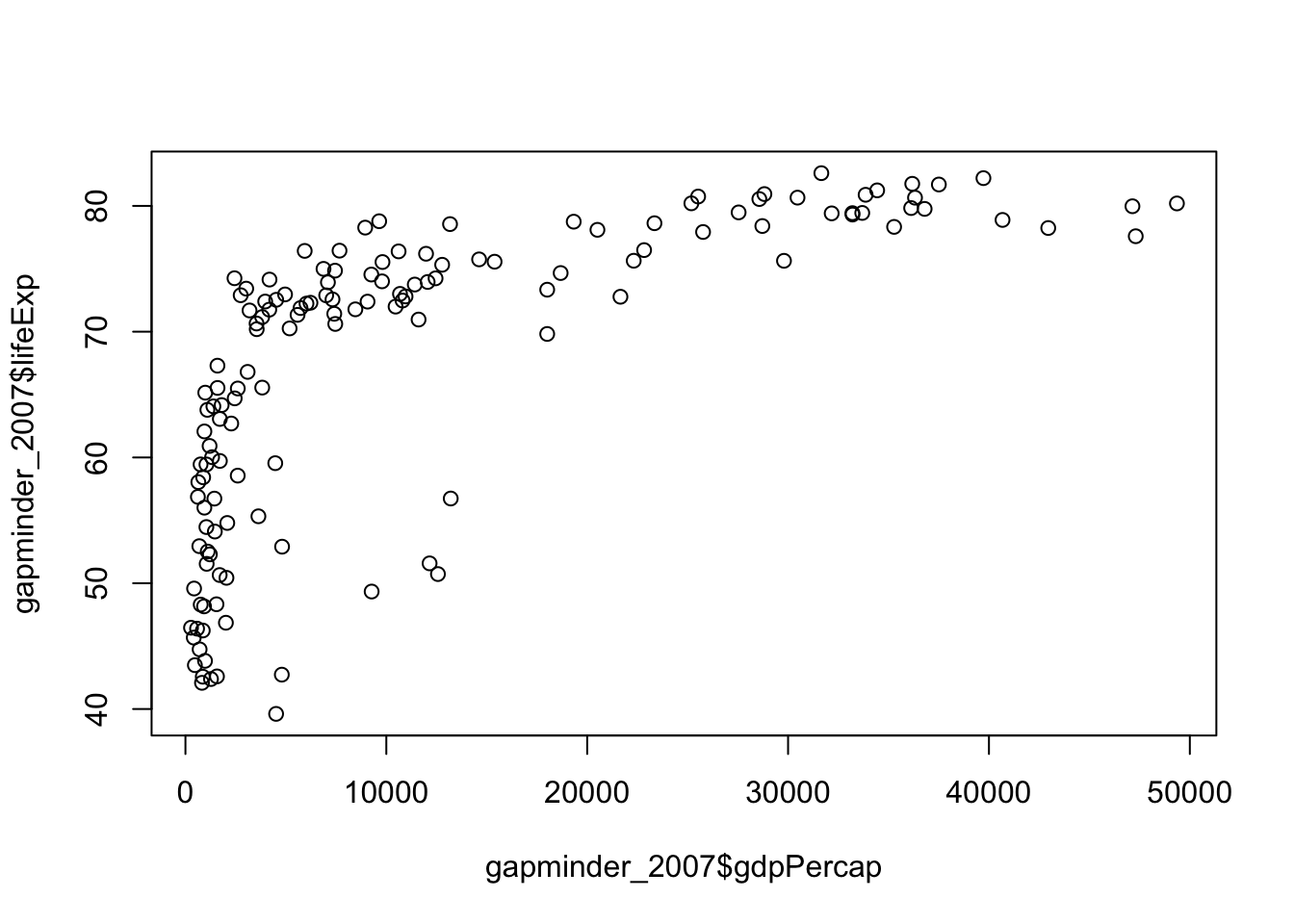

So it looks like both the gdp and life expectancy are skewed (as their z-scores are greater than 1.96). Lets double check with a quick plot:

plot(

gapminder_2007$gdpPercap,

gapminder_2007$lifeExp

)

import matplotlib.pyplot as plt

# Create a scatter plot

plt.figure(figsize=(10, 6))

plt.scatter(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'], alpha=0.6)

plt.title('Scatter Plot of GDP per Capita vs. Life Expectancy (2007)')

plt.xlabel('GDP per Capita')

plt.ylabel('Life Expectancy')

plt.grid(True)

# Show the plot

plt.show()

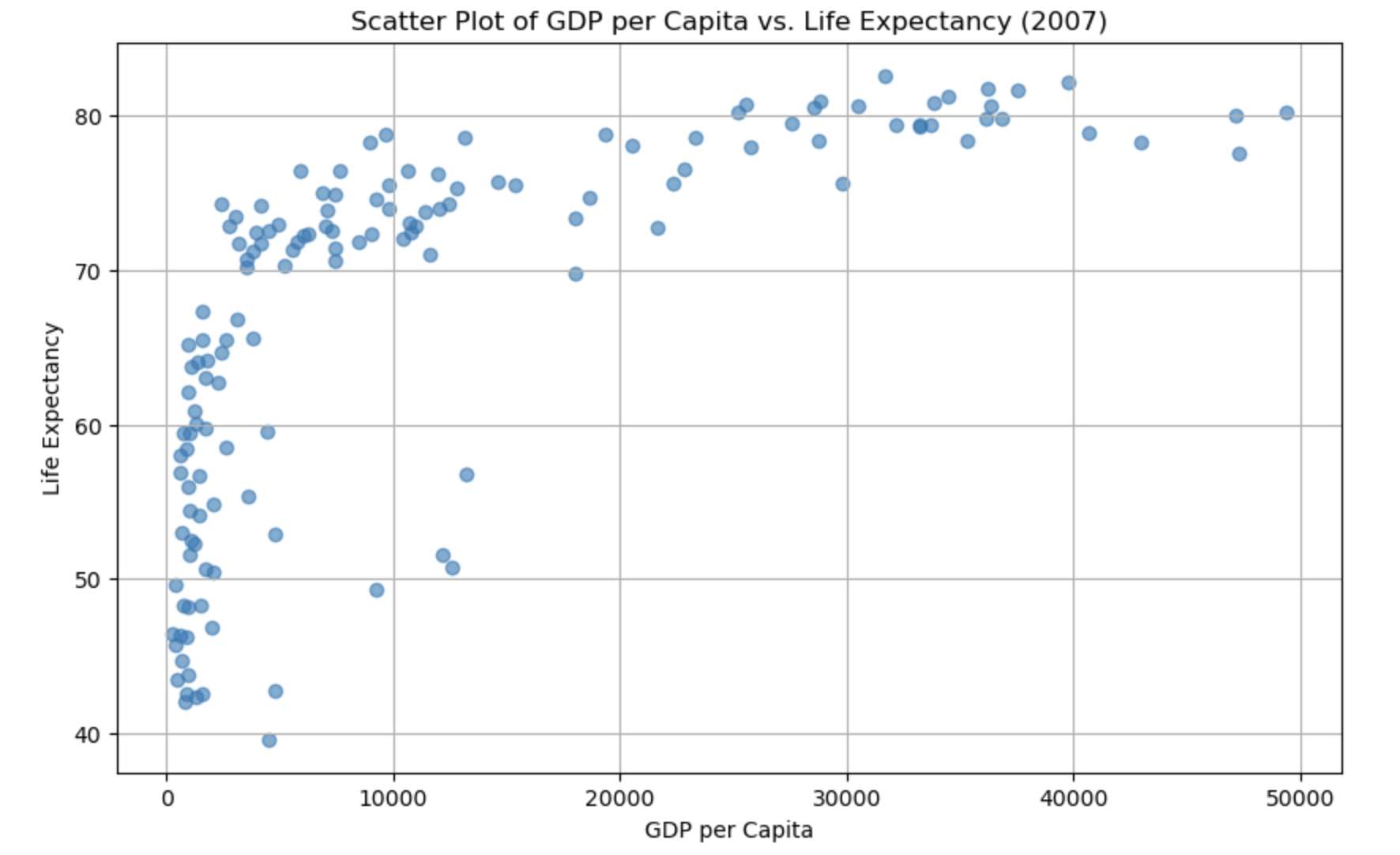

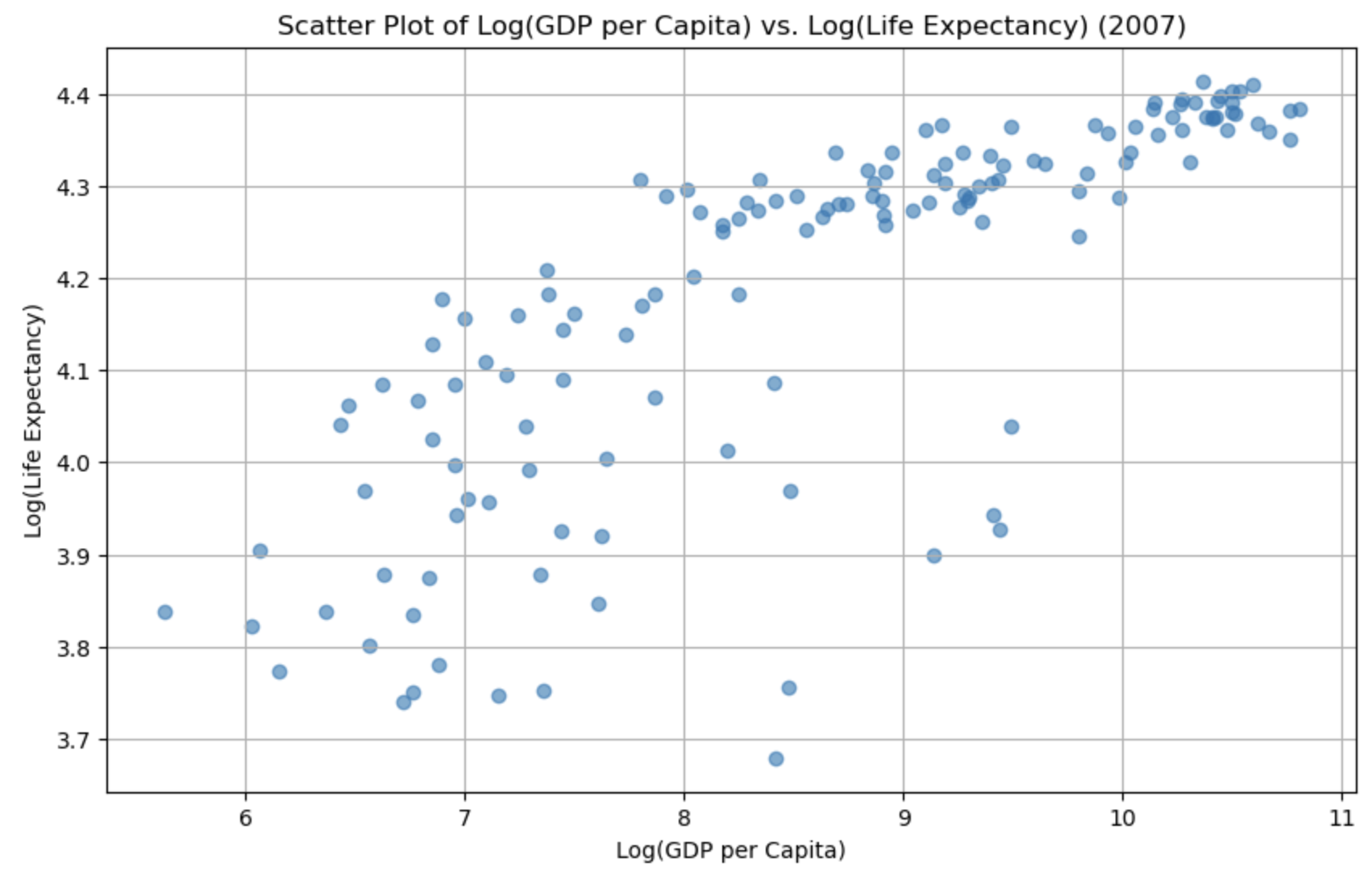

It’s relatively easy to see the skewness of gdp, but life expectancy is a bit more subtle. As the data is skewed, we may want to transform it to make it less skewed.

We can complete a logarithmic transformation to reduce the skewness, so lets do that to both variables and then replot the data:

gapminder_2007$gdpPercap_log <- log(gapminder_2007$gdpPercap)

gapminder_2007$lifeExp_log <- log(gapminder_2007$lifeExp)

plot(

gapminder_2007$gdpPercap_log,

gapminder_2007$lifeExp_log

)

# Calculate the logarithms of 'gdpPercap' and 'lifeExp'

gapminder_2007['gdpPercap_log'] = np.log(gapminder_2007['gdpPercap'])

gapminder_2007['lifeExp_log'] = np.log(gapminder_2007['lifeExp'])

# Create a scatter plot of the log-transformed variables

plt.figure(figsize=(10, 6))

plt.scatter(gapminder_2007['gdpPercap_log'], gapminder_2007['lifeExp_log'], alpha=0.6)

plt.title('Scatter Plot of Log(GDP per Capita) vs. Log(Life Expectancy) (2007)')

plt.xlabel('Log(GDP per Capita)')

plt.ylabel('Log(Life Expectancy)')

plt.grid(True)

# Show the plot

plt.show()

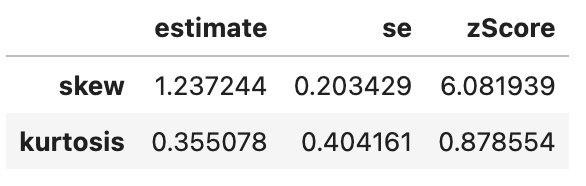

Lets check if the skewness has changed for the gdp:

# original gdp

spssSkewKurtosis(gapminder_2007$gdpPercap) estimate se zScore

skew 1.2241977 0.2034292 6.0178067

kurtosis 0.3500942 0.4041614 0.8662238# transformed gdp (log)

spssSkewKurtosis(gapminder_2007$gdpPercap_log) estimate se zScore

skew -0.1540524 0.2034292 -0.7572778

kurtosis -1.1256815 0.4041614 -2.7852277# original gdp

spssSkewKurtosis(gapminder_2007['gdpPercap'])

# transformed gdp (log)

spssSkewKurtosis(gapminder_2007['gdpPercap_log'])

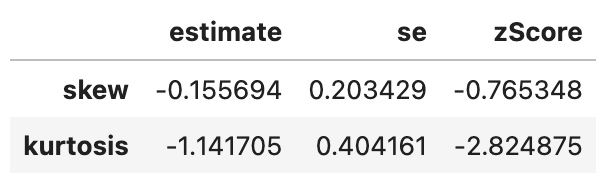

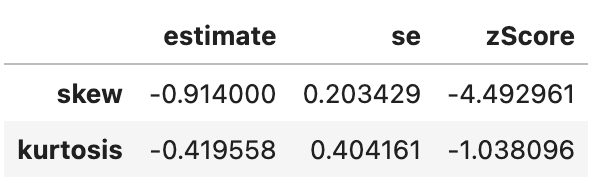

So, transforming the gdp did reduce skewness but increased kurtsosis, so beware that applying a transformation may cause other problems! Lets check whether the log transformation reduced skewness for life expectancy:

# original life expectancy

spssSkewKurtosis(gapminder_2007$lifeExp) estimate se zScore

skew -0.6887771 0.2034292 -3.385832

kurtosis -0.8298204 0.4041614 -2.053191# transformed life expectancy (log)

spssSkewKurtosis(gapminder_2007$lifeExp_log) estimate se zScore

skew -0.9043617 0.2034292 -4.445584

kurtosis -0.4136699 0.4041614 -1.023527# original life expectancy

spssSkewKurtosis(gapminder_2007['lifeExp'])

# transformed life expectancy (log)

spssSkewKurtosis(gapminder_2007['lifeExp_log'])

Seems like the answer is no.

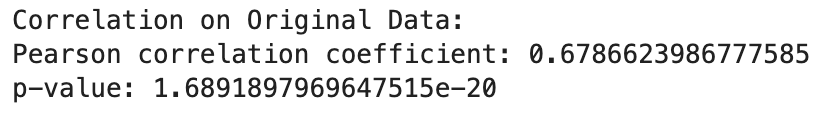

An important question is whether the associations between your variables change after transformation, so let’s check that next:

# correlation on original data

cor.test(

gapminder_2007$gdpPercap,

gapminder_2007$lifeExp

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap and gapminder_2007$lifeExp

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

0.6786624 # correlation on transformed data

cor.test(

gapminder_2007$gdpPercap_log,

gapminder_2007$lifeExp_log

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap_log and gapminder_2007$lifeExp_log

t = 14.752, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.7060729 0.8372165

sample estimates:

cor

0.7800706 from scipy import stats

# Perform a correlation test on the original data

correlation_original = stats.pearsonr(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'])

# Perform a correlation test on the transformed data

correlation_transformed = stats.pearsonr(gapminder_2007['gdpPercap_log'], gapminder_2007['lifeExp_log'])

# Print the correlation results

print("Correlation on Original Data:")

print("Pearson correlation coefficient:", correlation_original[0])

print("p-value:", correlation_original[1])

print("\nCorrelation on Transformed Data:")

print("Pearson correlation coefficient:", correlation_transformed[0])

print("p-value:", correlation_transformed[1])

The log transformed data is more strongly associated with each other than the original data. However, not all transformations will change associations between variables.

Linear vs. non-linear transformations

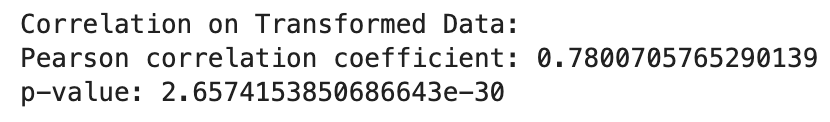

Linear transformation includes adding, subtracting from, multiplying or dividing variables. These transformations change the absolute value, but not pattern of the distribution of the variable. Let’s use life expectancy to illustrate how linear transformations change the absolute values without changing the distribution.

Additive transformations

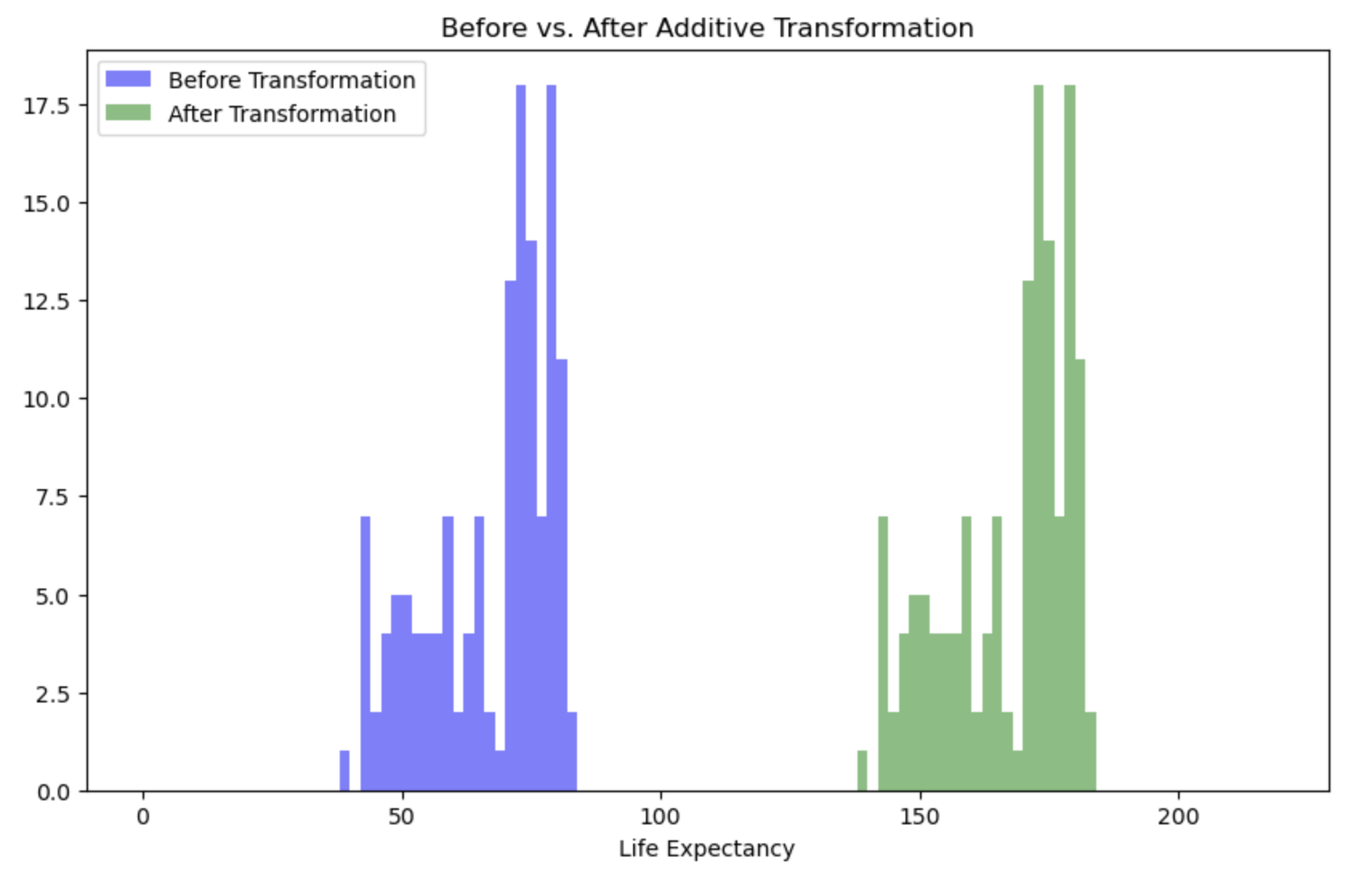

If you added 100 to the life expectancy for all countries, you would change the absolute value:

# before transformation

mean(gapminder_2007$lifeExp)[1] 67.00742# after transformation

mean(gapminder_2007$lifeExp + 100)[1] 167.0074# before transformation

gapminder_2007['lifeExp'].mean()

# after transformation

np.mean(gapminder_2007['lifeExp'] + 100)67.00742253521126167.00742253521128There’s a big difference between the means, but all we’ve done is shift the distribution up 100, we haven’t made it wider or thinner:

# before transformation

sd(gapminder_2007$lifeExp)[1] 12.07302# after transformation

sd(gapminder_2007$lifeExp + 100)[1] 12.07302# before transformation [use ddof =1 for sample sd, and ddof=0 for population sd]

np.std(gapminder_2007['lifeExp'], ddof=1)

# after transformation [use ddof =1 for sample sd, and ddof=0 for population sd]

np.std(gapminder_2007['lifeExp'] + 100, ddof=1)12.0730205022251212.07302050222512If we were to visualise this transformation

life_exp_before_after <- data.frame(

life_exp = c(gapminder_2007$lifeExp, gapminder_2007$lifeExp + 100),

tranformed = c(rep("before", each = 142), rep("after", each =142))

)

ggplot(life_exp_before_after, aes(x=life_exp, fill=tranformed)) +

geom_histogram(binwidth = 2, alpha=.5, position = "identity") +

ggtitle("Before vs. after additive transformation")

# Create a DataFrame for 'lifeExp' before and after the transformation

life_exp_before_after = pd.DataFrame({

'life_exp': np.concatenate([gapminder_2007['lifeExp'], gapminder_2007['lifeExp'] + 100]),

'transformed': np.concatenate([np.repeat('before', len(gapminder_2007)), np.repeat('after', len(gapminder_2007))])

})

# Create a histogram

plt.figure(figsize=(10, 6))

plt.hist(life_exp_before_after[life_exp_before_after['transformed'] == 'before']['life_exp'],

bins=range(0, 120, 2), alpha=0.5, label='Before Transformation', color='blue')

plt.hist(life_exp_before_after[life_exp_before_after['transformed'] == 'after']['life_exp'],

bins=range(0, 220, 2), alpha=0.5, label='After Transformation', color='green')

plt.title("Before vs. After Additive Transformation")

plt.xlabel("Life Expectancy")

plt.legend()

# Show the histogram

plt.show()

We can see above that there is no difference in the shape of the distributions, but a shift. You would get the same pattern shifted also if you had subtracted from the original data. As a result, any association between the transformed variable and another variable will be the same as it was before the transformation as the shapes of the distributions are still the same.

Multiplicative transformations

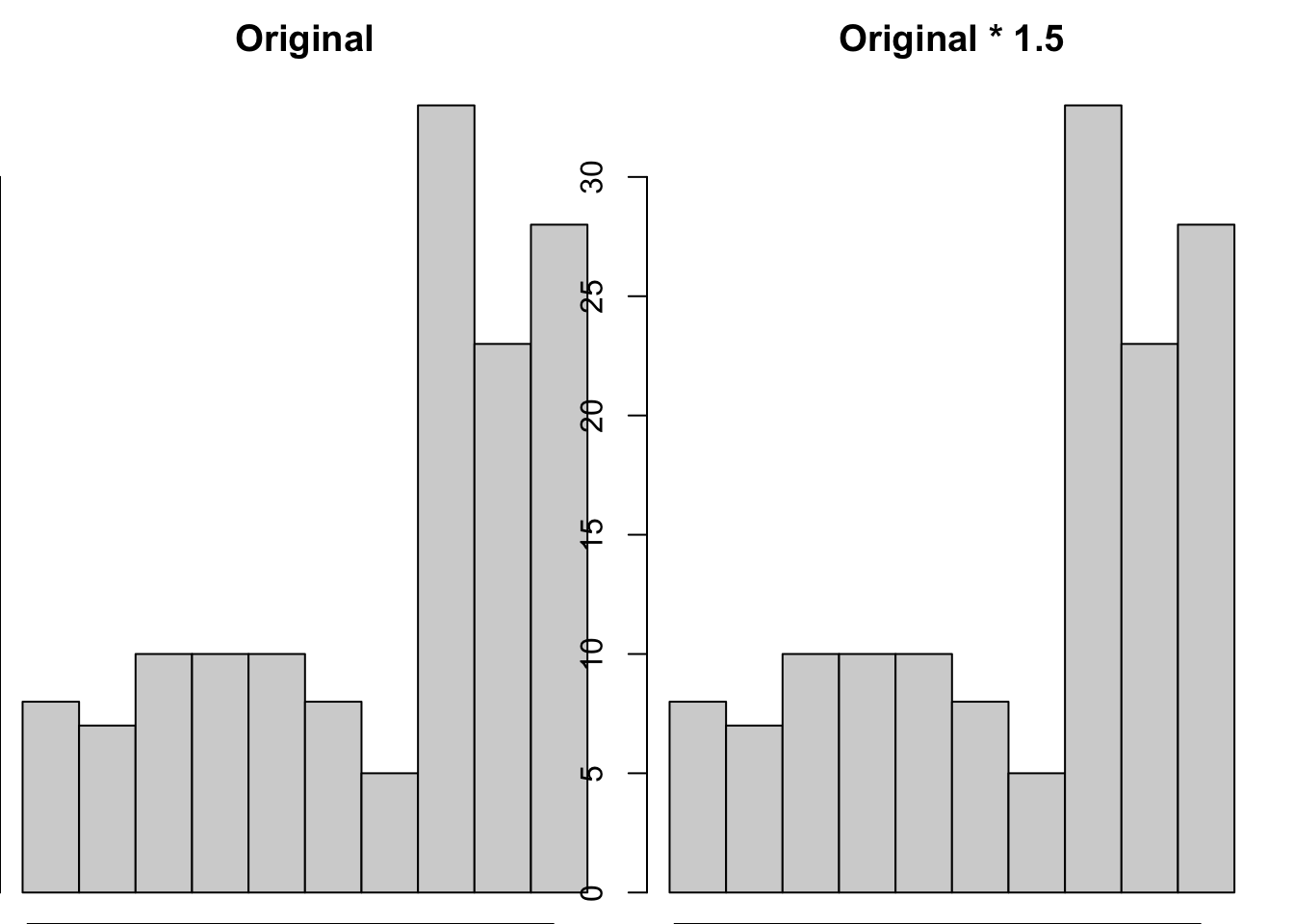

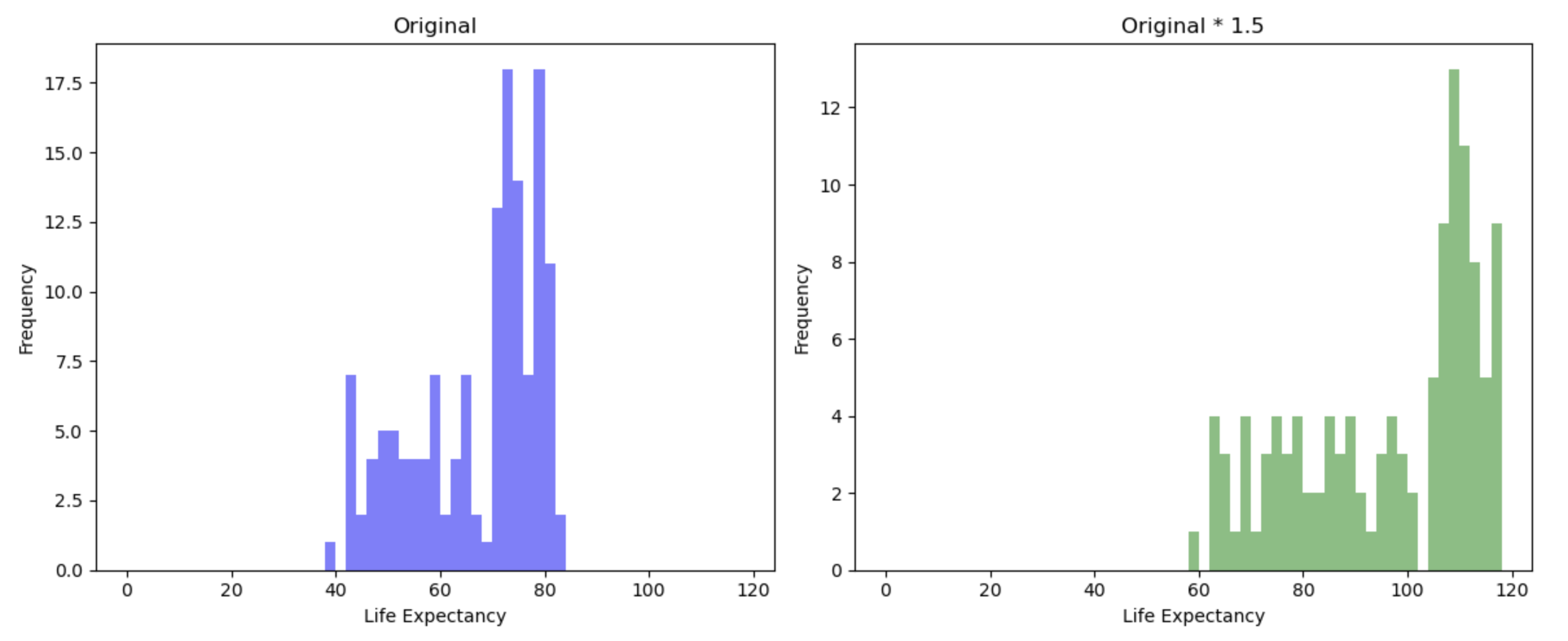

If you multiplied the life expectancy by 1.5 then you would change both the mean

# before transformation

mean(gapminder_2007$lifeExp)[1] 67.00742# after transformation

mean(gapminder_2007$lifeExp * 1.5)[1] 100.5111# before transformation

gapminder_2007['lifeExp'].mean()

# after transformation

np.mean(gapminder_2007['lifeExp'] * 1.5)67.00742253521126100.51113380281689and SD of life expectancy

# before transformation

sd(gapminder_2007$lifeExp)[1] 12.07302# after transformation

sd(gapminder_2007$lifeExp * 1.5)[1] 18.10953# before transformation [use ddof =1 for sample sd, and ddof=0 for population sd]

np.std(gapminder_2007['lifeExp'], ddof=1)

# after transformation [use ddof =1 for sample sd, and ddof=0 for population sd]

np.std(gapminder_2007['lifeExp'] * 1.5, ddof=1)12.0730205022251218.109530753337683We established above that changing the mean isn’t sufficient to change the shape of a distribution, but would changing the standard deviation change the shape of the distribution. Let’s put two histograms of each distribution side by side to evaluate this:

par(mfrow = c(1,2),

mar = c(0,0,2,1))

hist(gapminder_2007$lifeExp, breaks = seq(min(gapminder_2007$lifeExp), max(gapminder_2007$lifeExp), length.out = 11), main = "Original")

hist(gapminder_2007$lifeExp*1.5, breaks = seq(min(gapminder_2007$lifeExp*1.5), max(gapminder_2007$lifeExp*1.5), length.out = 11), main = "Original * 1.5")

# Create subplots with two histograms

fig, axs = plt.subplots(1, 2, figsize=(12, 5))

# Plot the original 'lifeExp' histogram

axs[0].hist(gapminder_2007['lifeExp'],bins=range(0, 120, 2), alpha=0.5, label='Before Transformation', color='blue')

axs[0].set_title("Original")

axs[0].set_xlabel("Life Expectancy")

axs[0].set_ylabel("Frequency")

# Plot the 'lifeExp' * 1.5 histogram

axs[1].hist(gapminder_2007['lifeExp'] * 1.5, bins=range(0, 120, 2), color='green', alpha=0.5)

axs[1].set_title("Original * 1.5")

axs[1].set_xlabel("Life Expectancy")

axs[1].set_ylabel("Frequency")

# Adjust layout

plt.tight_layout()

# Show the histograms

plt.show()

We can see that the shape/pattern of the distribution is the same, and so the association between the transformed variable and other variables will stay the same after transformation. This is because associations between variables ignore the scale of either variable.

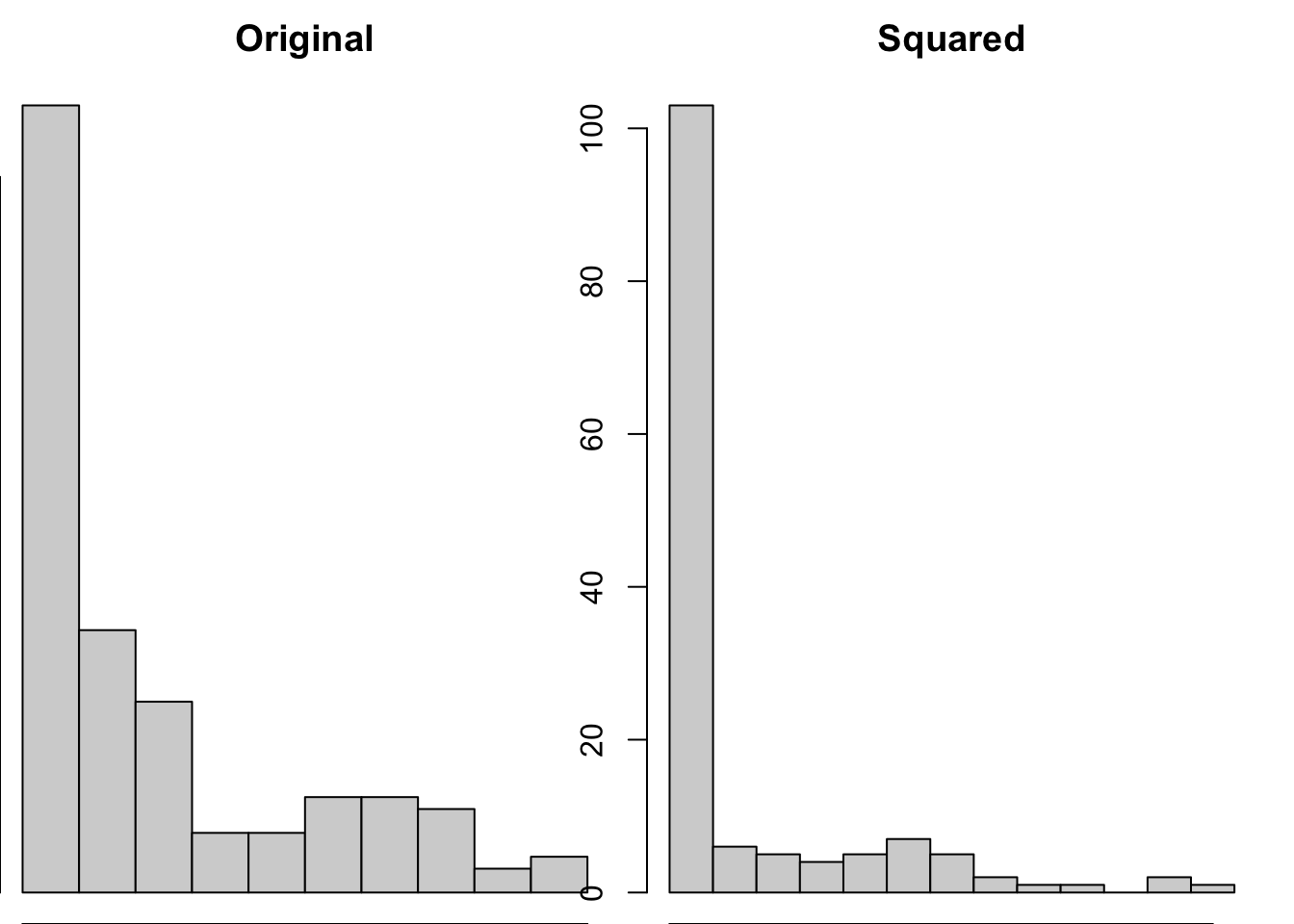

Non-linear transformations

Unlike linear transformations, non-linear transformations change the shape of distributions. There are a wide variety of non-linear transformations you could apply to a variable, such as…

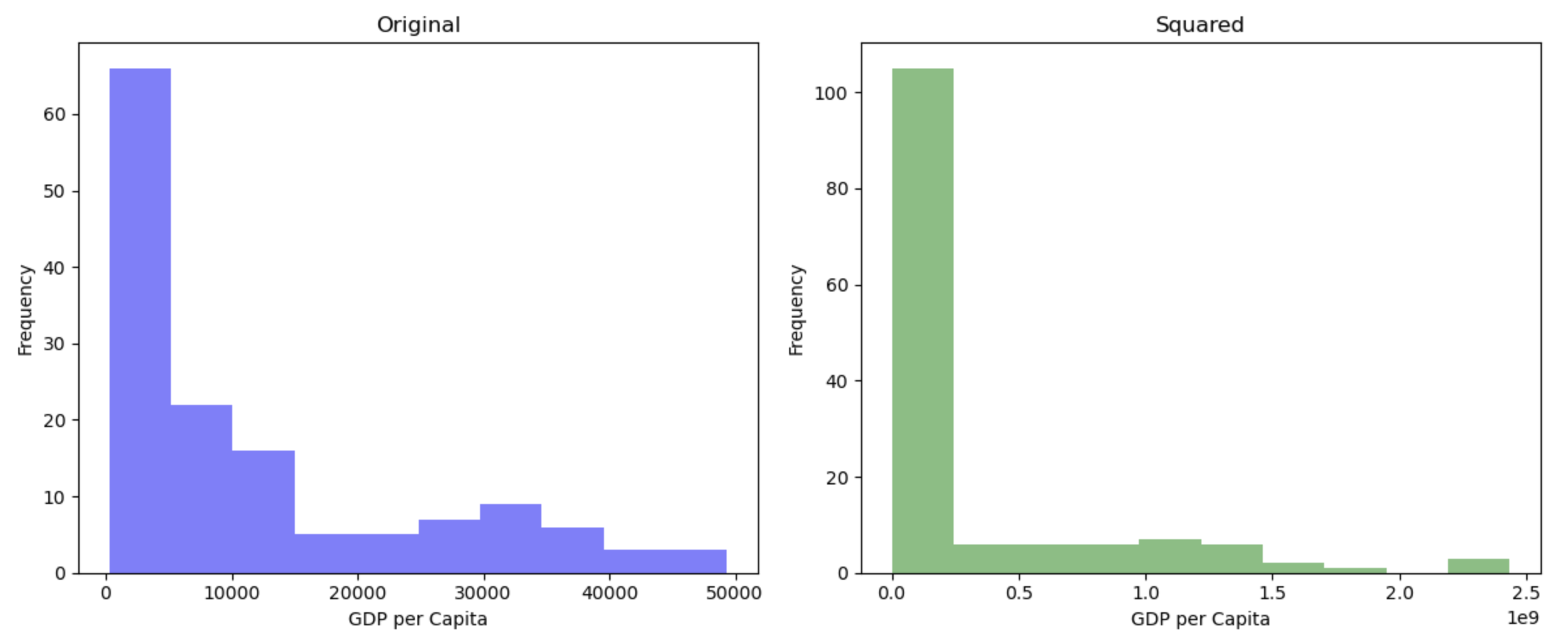

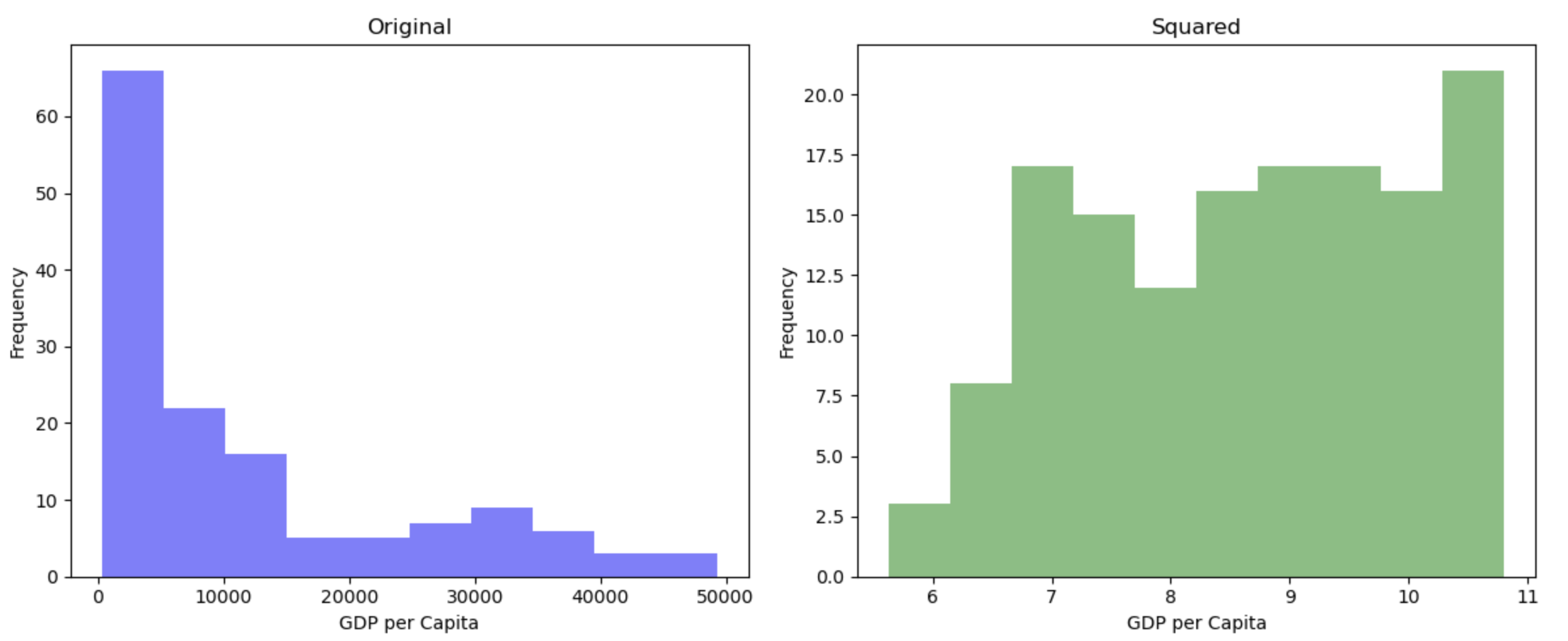

Square (\(^2\))

par(mfrow = c(1,2),

mar = c(0,0,2,1))

hist(gapminder_2007$gdpPercap, main = "Original")

hist(gapminder_2007$gdpPercap^2, main = "Squared")

# Create subplots with two histograms

fig, axs = plt.subplots(1, 2, figsize=(12, 5))

# Plot the original 'gdpPercap' histogram

axs[0].hist(gapminder_2007['gdpPercap'], alpha=0.5, label='Before Transformation', color='blue')

axs[0].set_title("Original")

axs[0].set_xlabel("Life Expectancy")

axs[0].set_ylabel("Frequency")

# Plot the squared 'gdpPercap' histogram

axs[1].hist(np.square(gapminder_2007['gdpPercap']), color='green', alpha=0.5)

axs[1].set_title("Squared")

axs[1].set_xlabel("Life Expectancy")

axs[1].set_ylabel("Frequency")

# Adjust layout

plt.tight_layout()

# Show the histograms

plt.show()

Squaring data is likely to make the distributions more extreme, and so isn’t often a pragmatic solution to try to make your data less skewed.

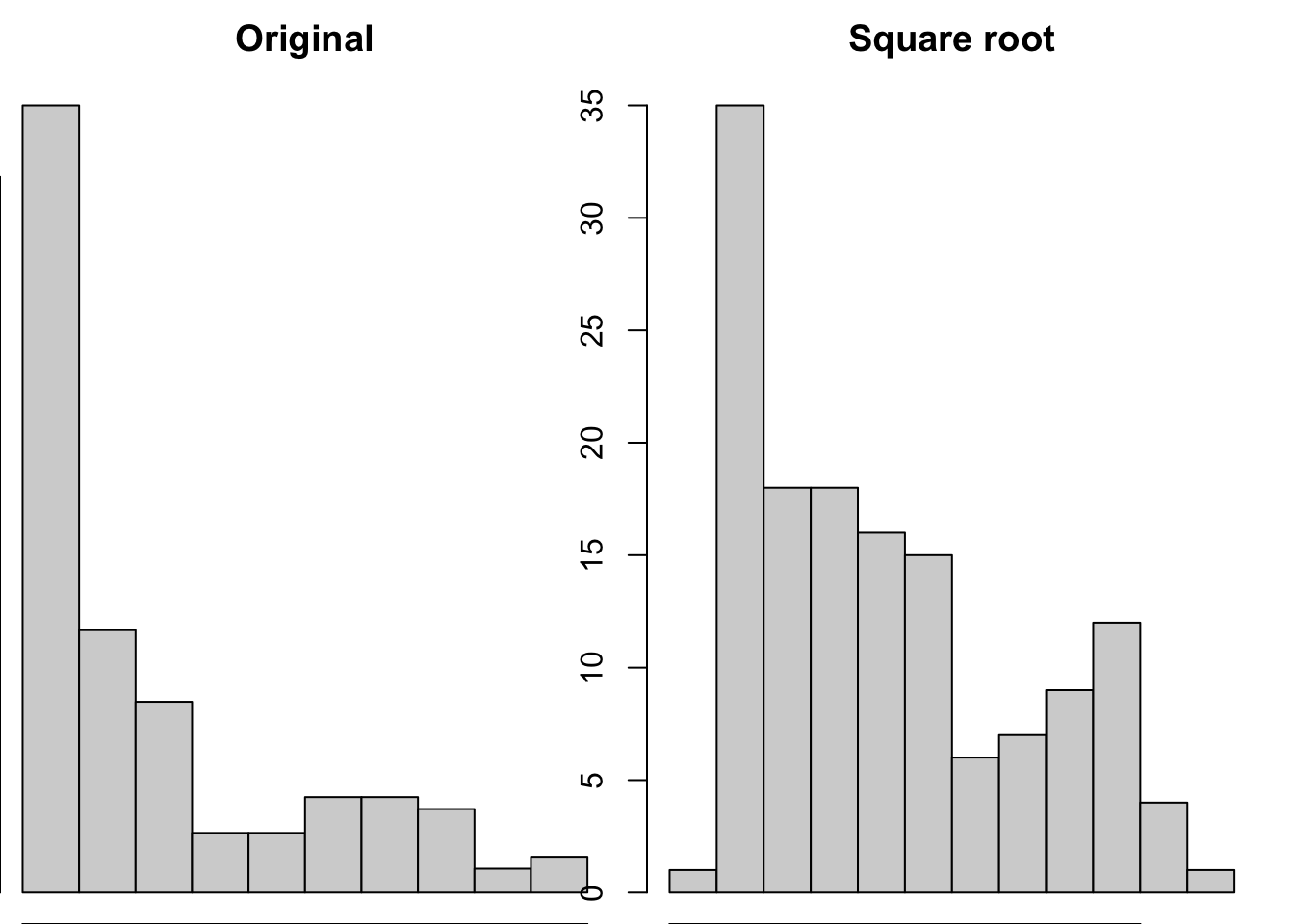

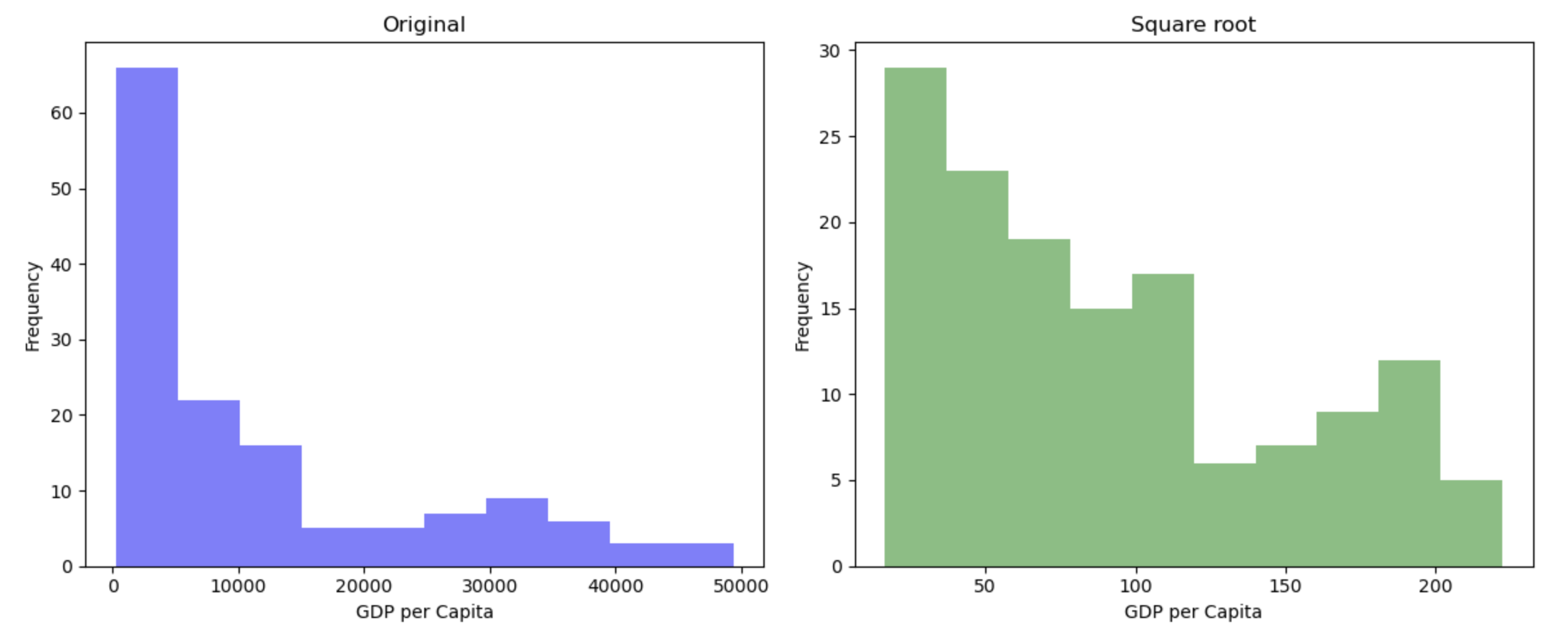

Square root (\(\sqrt{}\))

par(mfrow = c(1,2),

mar = c(0,0,2,1))

hist(gapminder_2007$gdpPercap, main = "Original")

hist(sqrt(gapminder_2007$gdpPercap), main = "Square root")

# Create subplots with two histograms

fig, axs = plt.subplots(1, 2, figsize=(12, 5))

# Plot the original 'gdpPercap' histogram

axs[0].hist(gapminder_2007['gdpPercap'], alpha=0.5, label='Before Transformation', color='blue')

axs[0].set_title("Original")

axs[0].set_xlabel("GDP per Capita")

axs[0].set_ylabel("Frequency")

# Plot the square root 'gdpPercap' histogram

axs[1].hist(np.sqrt(gapminder_2007['gdpPercap']), color='green', alpha=0.5)

axs[1].set_title("Square root")

axs[1].set_xlabel("GDP per Capita")

axs[1].set_ylabel("Frequency")

# Adjust layout

plt.tight_layout()

# Show the histograms

plt.show()

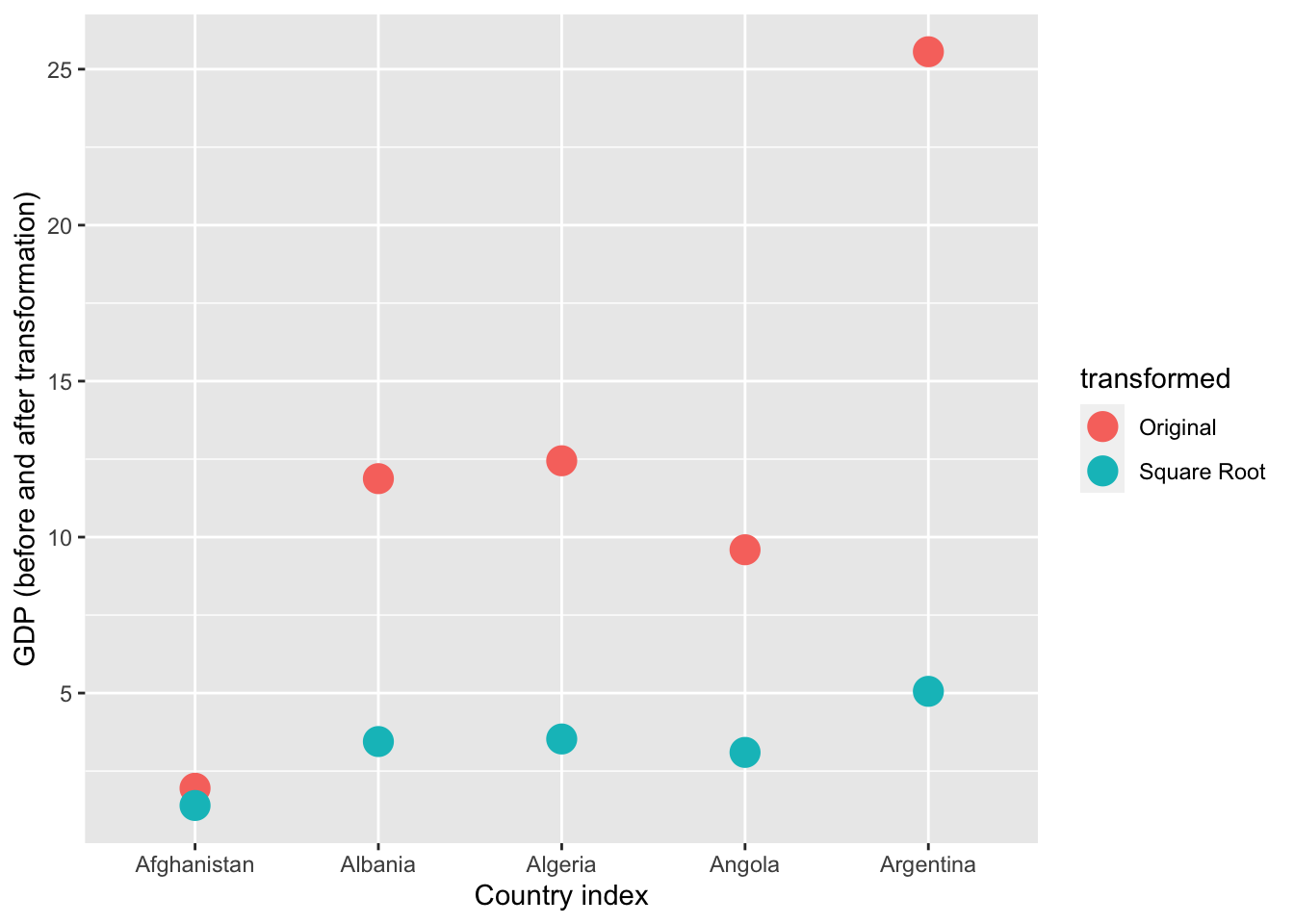

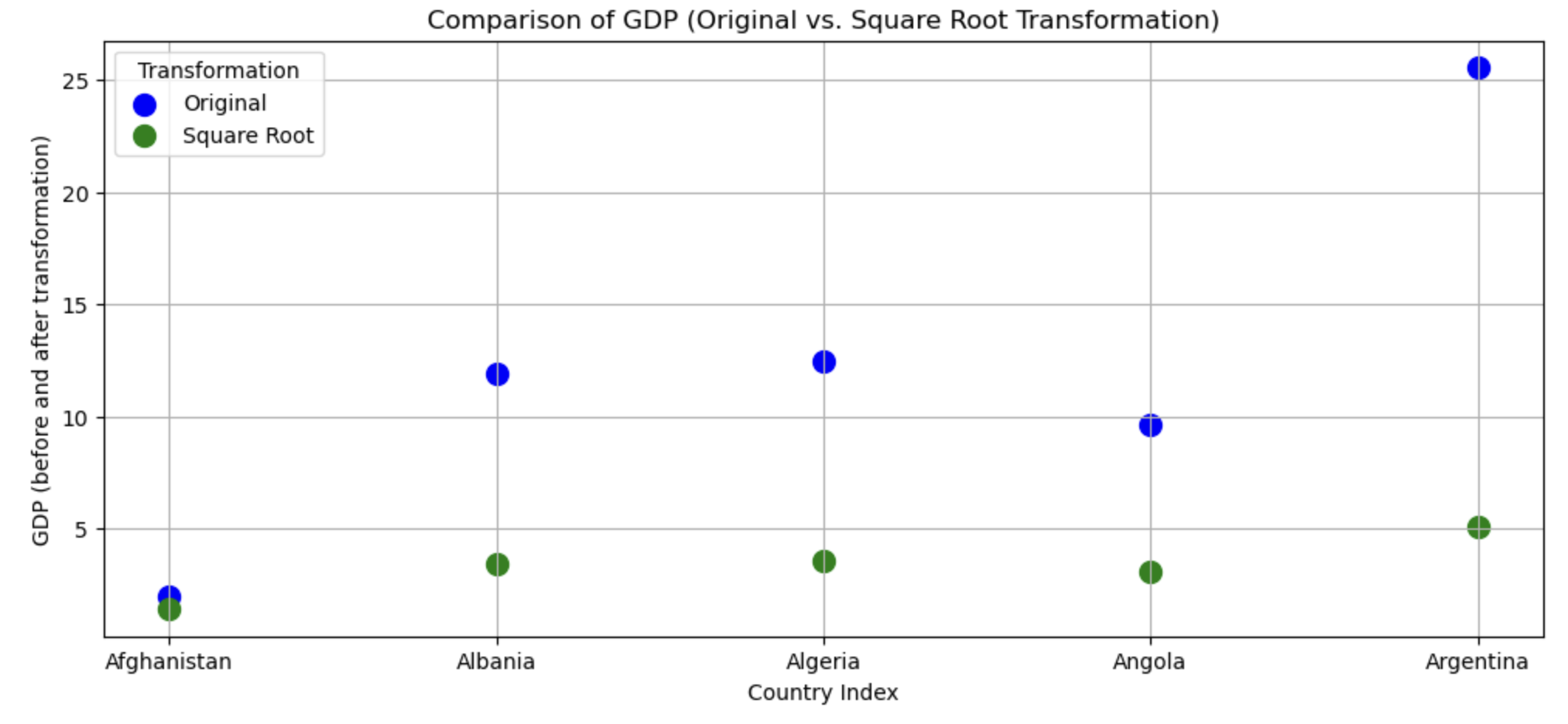

This transformation appears to have reduced the skewness of the distribution. Calculating the square root of a variable will disproportionately reduce extreme values compared to less extreme values. This might be more clearly shown by looking at the change in the individual data points:

# focusing on 5 countries to make it visually easier

gapminder_sqrt <- data.frame(

country = gapminder_2007$country[1:5],

transformed = c(

rep("Original",5),

rep("Square Root",5)

),

# gdp has been divided by 500 to make the comparisons more visible

gdp = c(gapminder_2007$gdpPercap[1:5]/500, sqrt(gapminder_2007$gdpPercap[1:5]/500))

)

ggplot(gapminder_sqrt, aes(x=country, y = gdp, color = transformed)) +

geom_point(size=5) +

xlab("Country index") +

ylab("GDP (before and after transformation)")

# Sample data for 5 countries

data = pd.DataFrame({

'Country': gapminder_2007['country'].iloc[:5].tolist() * 2,

'Transformation': ['Original'] * 5 + ['Square Root'] * 5,

'GDP': (gapminder_2007['gdpPercap'].iloc[:5] / 500).tolist() + (np.sqrt(gapminder_2007['gdpPercap'].iloc[:5] / 500)).tolist()

})

# Create a scatter plot

plt.figure(figsize=(12, 5))

colors = ['blue', 'green']

markers = ['o', 's']

for i, transformation in enumerate(['Original', 'Square Root']):

subset = data[data['Transformation'] == transformation]

plt.scatter(subset['Country'], subset['GDP'], label=transformation, color=colors[i], s=100)

plt.title("Comparison of GDP (Original vs. Square Root Transformation)")

plt.xlabel("Country Index")

plt.ylabel("GDP (before and after transformation)")

plt.legend(title='Transformation')

plt.grid(True)

# Show the plot

plt.show()

As you can see above, the original values (pink) that are higher are much more heavily reduced by square root transforming them than lower original values.

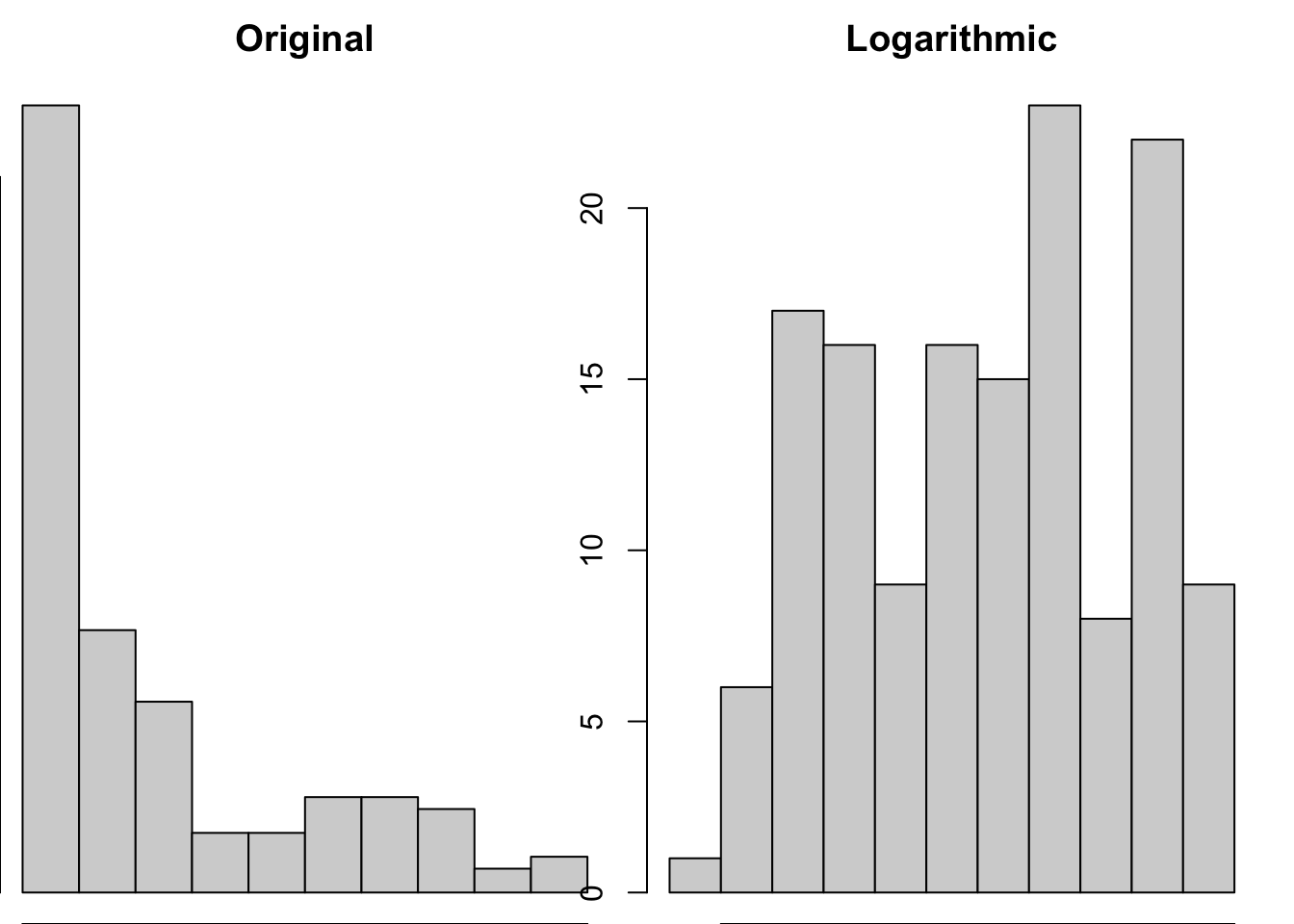

Logarithmic (\(\log\))

par(mfrow = c(1,2),

mar = c(0,0,2,1))

hist(gapminder_2007$gdpPercap, main = "Original")

hist(log(gapminder_2007$gdpPercap), main = "Logarithmic")

# Create subplots with two histograms

fig, axs = plt.subplots(1, 2, figsize=(12, 5))

# Plot the original 'gdpPercap' histogram

axs[0].hist(gapminder_2007['gdpPercap'], alpha=0.5, label='Before Transformation', color='blue')

axs[0].set_title("Original")

axs[0].set_xlabel("GDP per Capita")

axs[0].set_ylabel("Frequency")

# Plot the 'gdpPercap' * 1.5 histogram

axs[1].hist(np.log(gapminder_2007['gdpPercap']), color='green', alpha=0.5)

axs[1].set_title("Logarithmic")

axs[1].set_xlabel("GDP per Capita")

axs[1].set_ylabel("Frequency")

# Adjust layout

plt.tight_layout()

# Show the histograms

plt.show()

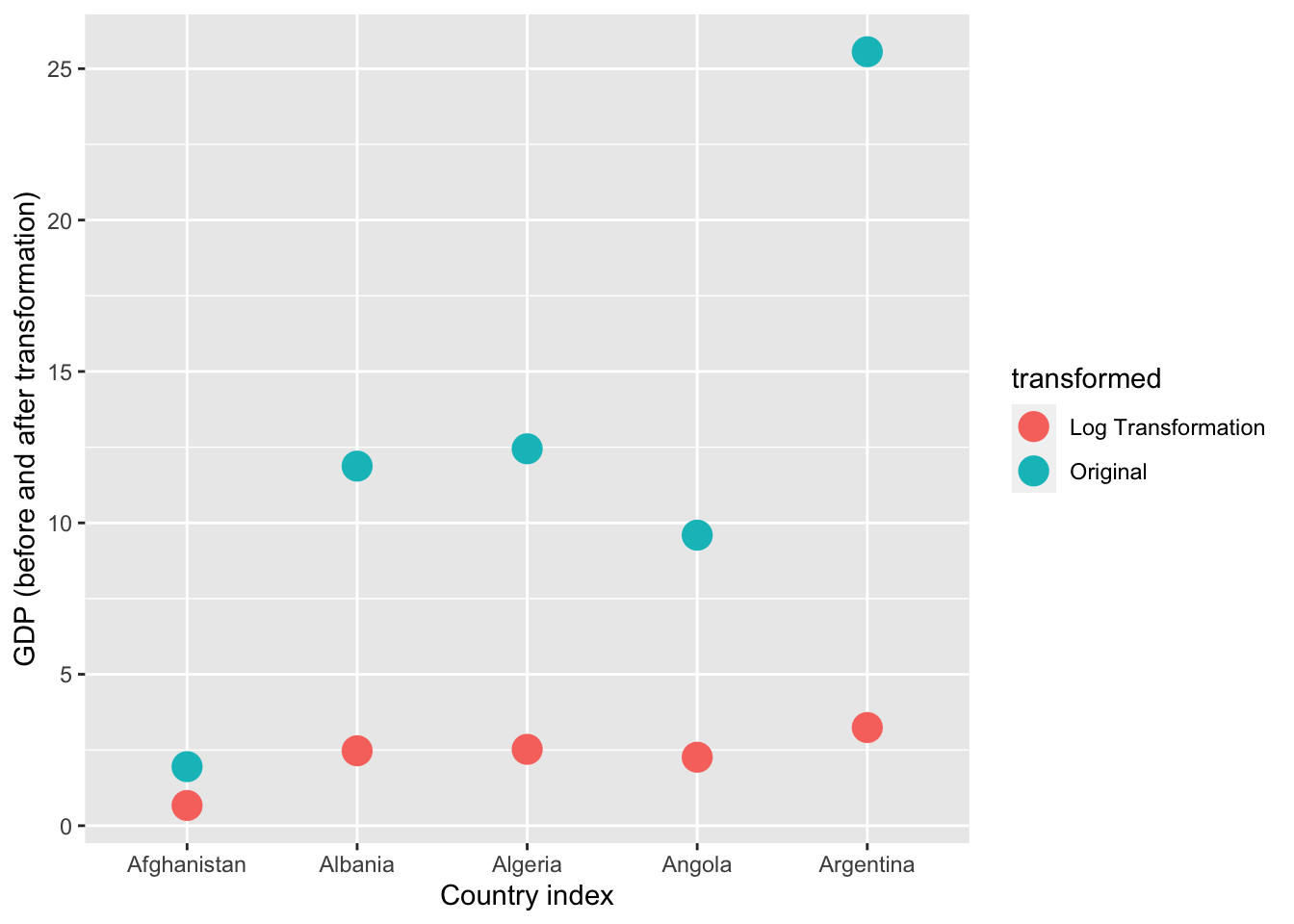

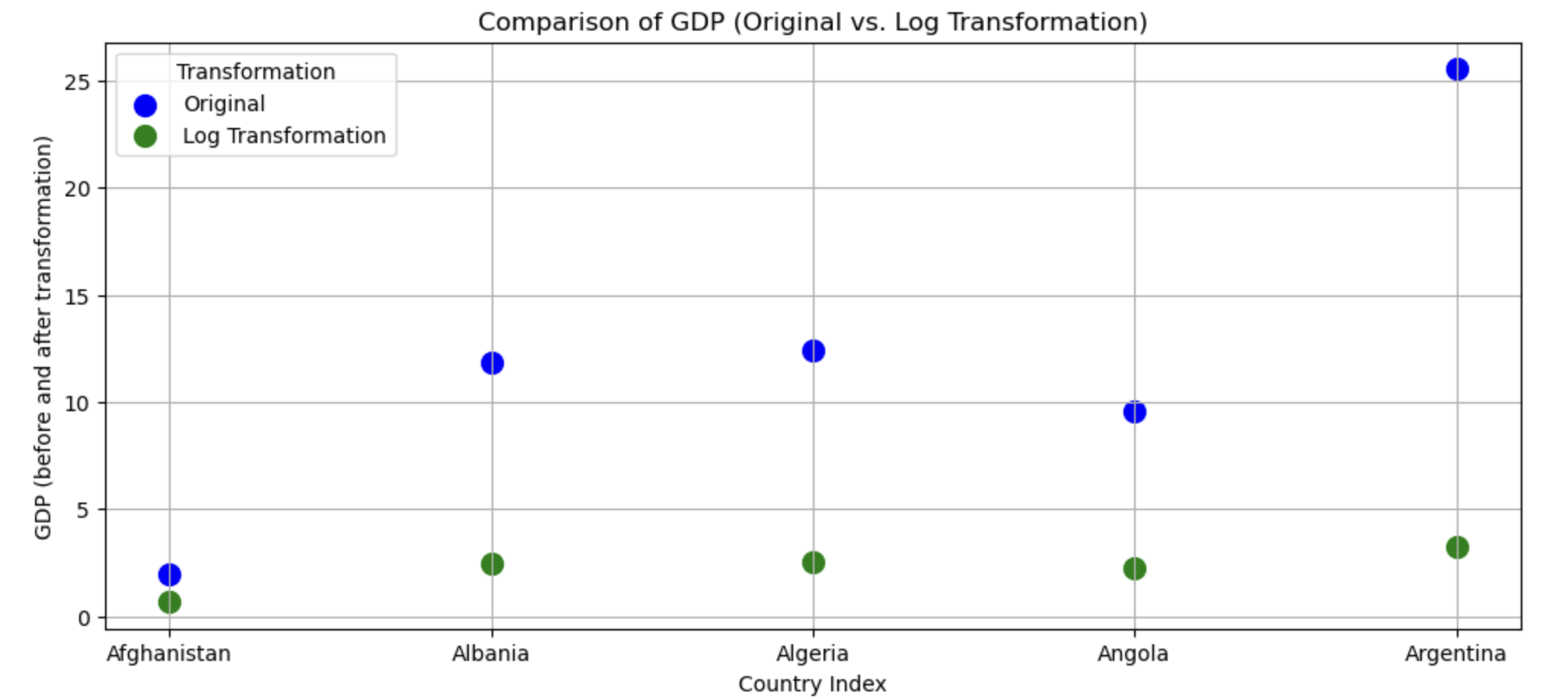

This transformation seems very successful in changing the distribution shape to be less skewed. Let’s see if the log transformation follows a similar pattern as the sqrt in disproportionately impacting larger values than smaller values.

# focusing on 5 countries to make it visually easier

gapminder_log <- data.frame(

country = gapminder_2007$country[1:5],

transformed = c(

rep("Original",5),

rep("Log Transformation",5)

),

# gdp has been divided by 500 to make the comparisons more visible

gdp = c(gapminder_2007$gdpPercap[1:5]/500, log(gapminder_2007$gdpPercap[1:5]/500))

)

ggplot(gapminder_log, aes(x=country, y = gdp, color = transformed)) +

geom_point(size=5) +

xlab("Country index") +

ylab("GDP (before and after transformation)")

# Sample data for 5 countries

data = pd.DataFrame({

'Country': gapminder_2007['country'].iloc[:5].tolist() * 2,

'Transformation': ['Original'] * 5 + ['Log Transformation'] * 5,

'GDP': (gapminder_2007['gdpPercap'].iloc[:5] / 500).tolist() + (np.log(gapminder_2007['gdpPercap'].iloc[:5] / 500)).tolist()

})

# Create a scatter plot

plt.figure(figsize=(12, 5))

colors = ['blue', 'green']

markers = ['o', 's']

for i, transformation in enumerate(['Original', 'Log Transformation']):

subset = data[data['Transformation'] == transformation]

plt.scatter(subset['Country'], subset['GDP'], label=transformation, color=colors[i], s=100)

plt.title("Comparison of GDP (Original vs. Log Transformation)")

plt.xlabel("Country Index")

plt.ylabel("GDP (before and after transformation)")

plt.legend(title='Transformation')

plt.grid(True)

# Show the plot

plt.show()

Yep, log also reduces skewness by disproportionately reducing higher values.

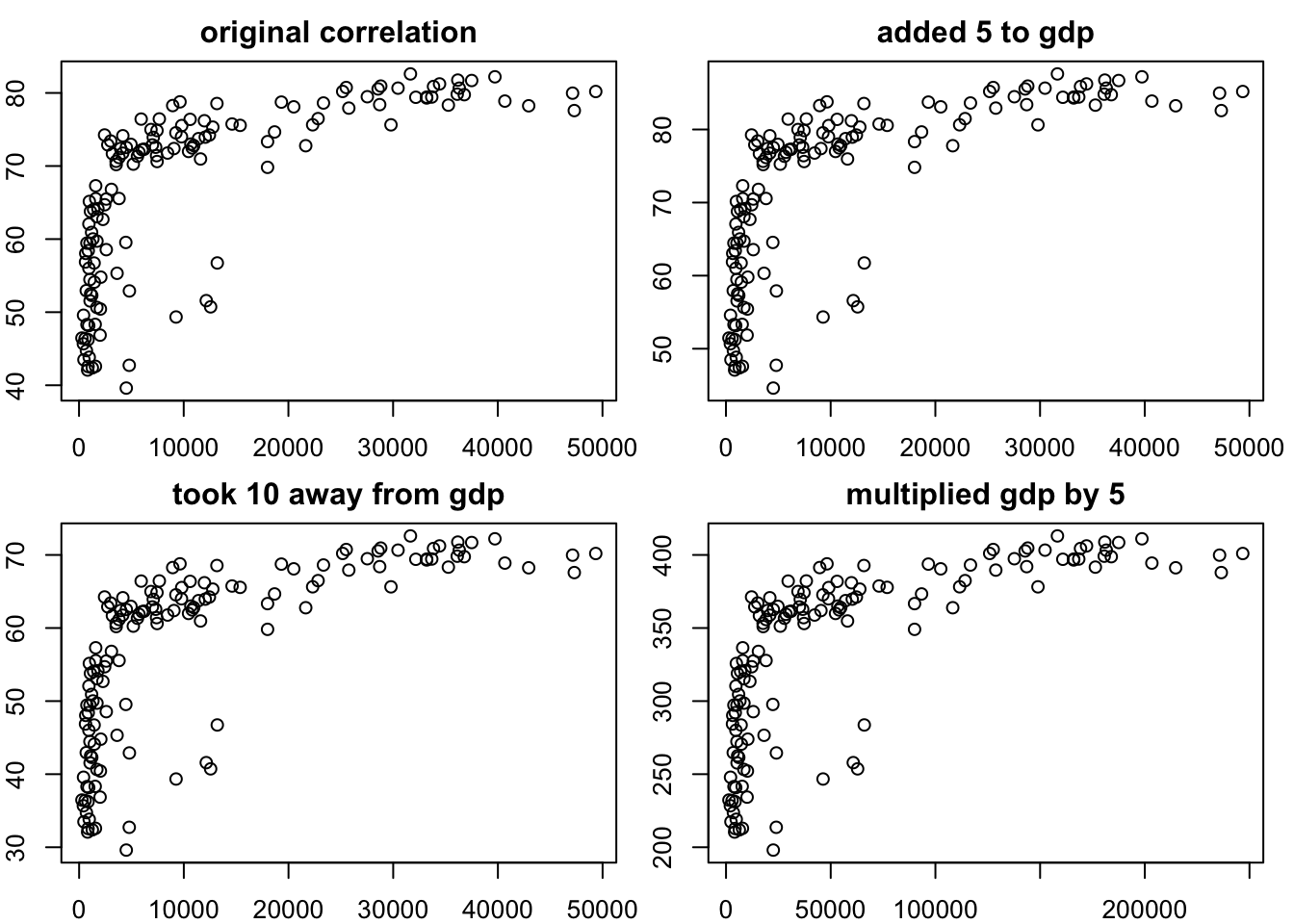

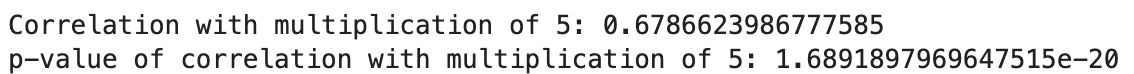

Linear transformations will not change the association between variables

You can transform a single variable by adding and multiplying it, but as these are linear transformations they do not change the shape of the distributions of the original variables, and thus do not change the association between variables. For example:

# correlation with original data

cor.test(

gapminder_2007$gdpPercap,

gapminder_2007$lifeExp

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap and gapminder_2007$lifeExp

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

0.6786624 # correlation with original data + 5 to one variable (an additive change)

cor.test(

gapminder_2007$gdpPercap + 5,

gapminder_2007$lifeExp + 5

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap + 5 and gapminder_2007$lifeExp + 5

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

0.6786624 # correlation with original data - 10 to one variable (an additive change)

cor.test(

gapminder_2007$gdpPercap - 10,

gapminder_2007$lifeExp - 10

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap - 10 and gapminder_2007$lifeExp - 10

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

0.6786624 # correlation with multiplication of 5 to one variable (multiplicative)

cor.test(

gapminder_2007$gdpPercap * 5,

gapminder_2007$lifeExp * 5

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap * 5 and gapminder_2007$lifeExp * 5

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

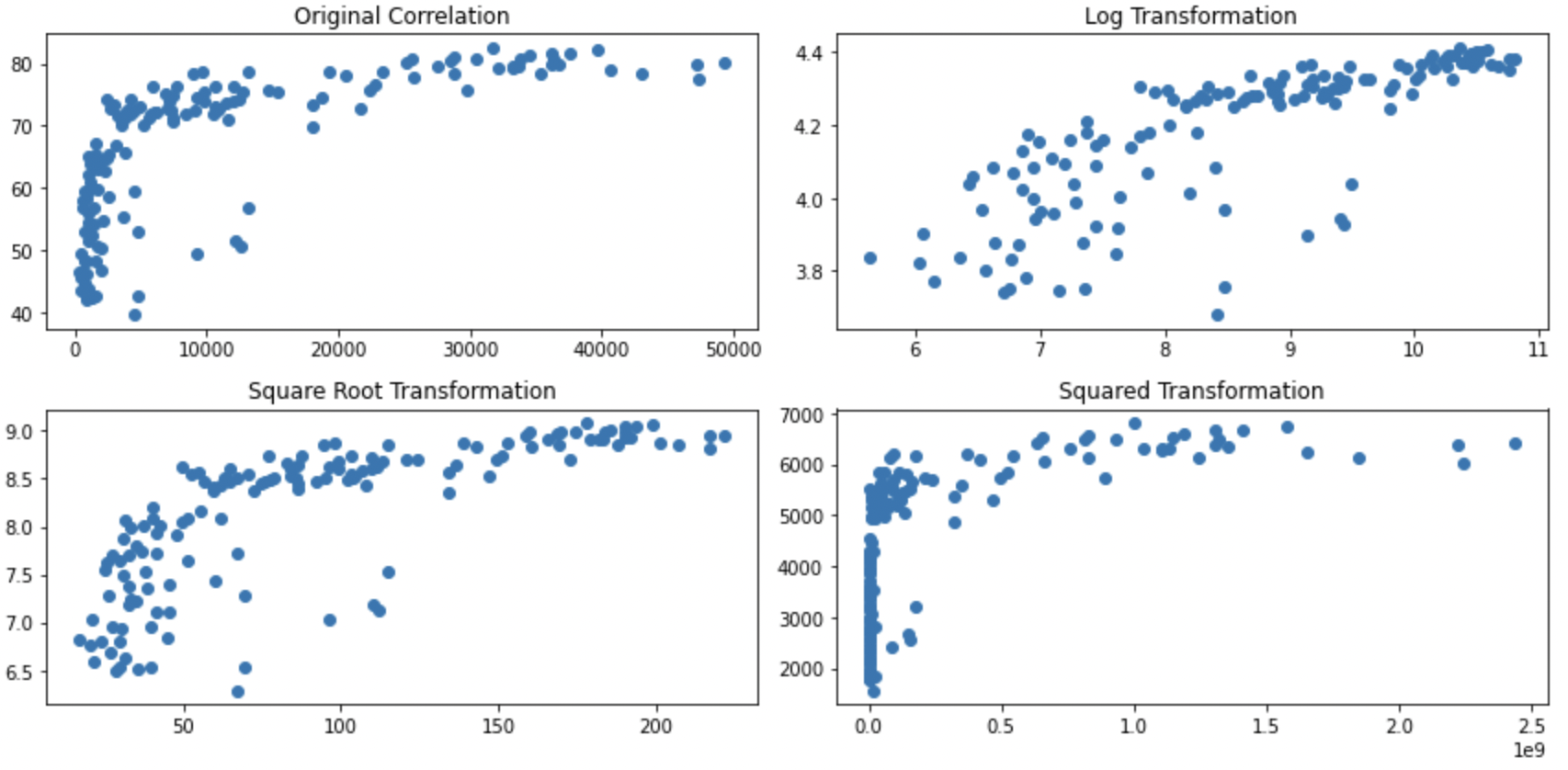

0.6786624 # grid comparing the 4 transformations

par(mfrow = c(2,2),

mar = c(2,2,2,1))

plot(gapminder_2007$gdpPercap, gapminder_2007$lifeExp, main="original correlation")

plot(gapminder_2007$gdpPercap + 5, gapminder_2007$lifeExp +5, main="added 5 to gdp")

plot(gapminder_2007$gdpPercap - 10, gapminder_2007$lifeExp - 10, main = "took 10 away from gdp")

plot(gapminder_2007$gdpPercap *5, gapminder_2007$lifeExp *5, main = "multiplied gdp by 5")

from scipy.stats import pearsonr

# Define the transformations

gdp_plus_5 = gapminder_2007['gdpPercap'] + 5

gdp_minus_10 = gapminder_2007['gdpPercap'] - 10

gdp_times_5 = gapminder_2007['gdpPercap'] * 5

life_plus_5 = gapminder_2007['lifeExp'] + 5

life_minus_10 = gapminder_2007['lifeExp'] - 10

life_times_5 = gapminder_2007['lifeExp'] * 5

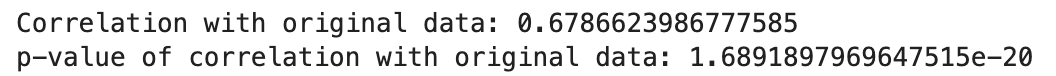

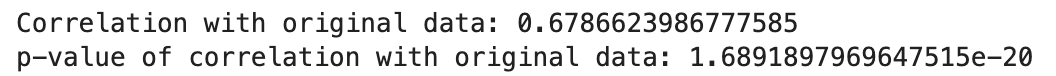

# correlation with original data

correlation_original, pvalue_original = pearsonr(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'])

print("Correlation with original data:", correlation_original)

print("p-value of correlation with original data:", pvalue_original)

# correlation with original data + 5 to both variables (an additive change)

correlation_plus_5, pvalue_plus_5 = pearsonr(gdp_plus_5, life_plus_5)

print("Correlation with original data + 5:", correlation_plus_5)

print("p-value of correlation with original data +5:", pvalue_plus_5)

# correlation with original data - 10 to both variables (an additive change)

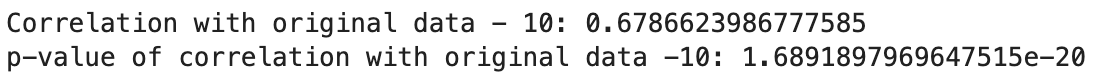

correlation_minus_10, pvalue_minus_10 = pearsonr(gdp_minus_10, life_minus_10)

print("Correlation with original data - 10:", correlation_minus_10)

print("p-value of correlation with original data -10:", pvalue_minus_10)

# correlation with multiplication of 5 to both variables (multiplicative)

correlation_times_5, pvalue_times_5 = pearsonr(gdp_times_5, life_times_5)

print("Correlation with multiplication of 5:", correlation_times_5)

print("p-value of correlation with multiplication of 5:", pvalue_times_5)

# Create a grid of scatter plots

plt.figure(figsize=(12, 6))

plt.subplot(2, 2, 1)

plt.scatter(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'])

plt.title("Original Correlation")

plt.subplot(2, 2, 2)

plt.scatter(gdp_plus_5, life_plus_5)

plt.title("Added 5P")

plt.subplot(2, 2, 3)

plt.scatter(gdp_minus_10, life_minus_10)

plt.title("Took 10 Away")

plt.subplot(2, 2, 4)

plt.scatter(gdp_times_5, life_times_5)

plt.title("Multiplied by 5")

plt.tight_layout()

plt.show()

You can see that the transformations being linear haven’t changed the nature of the associations.

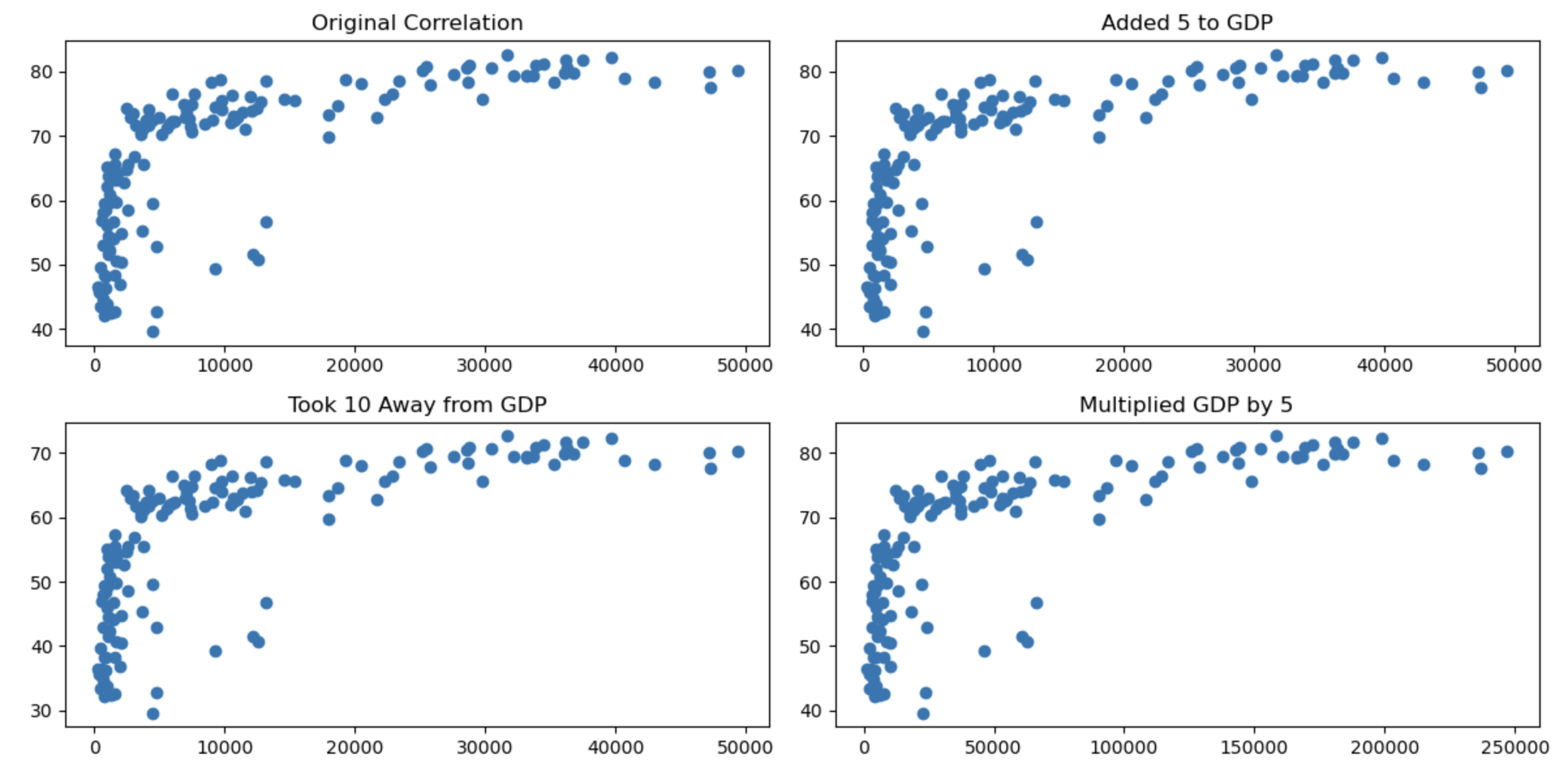

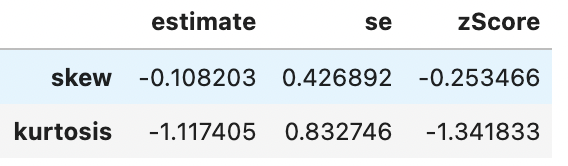

Non-linear transformations do change associations

If you apply non-linear transformations to one or both variables this will change the direction and strength of the associations. Below are some examples when you transform both variables:

# correlation with original data

cor.test(

gapminder_2007$gdpPercap,

gapminder_2007$lifeExp

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap and gapminder_2007$lifeExp

t = 10.933, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.5786217 0.7585843

sample estimates:

cor

0.6786624 # correlation with log of variables

cor.test(

log(gapminder_2007$gdpPercap),

log(gapminder_2007$lifeExp)

)

Pearson's product-moment correlation

data: log(gapminder_2007$gdpPercap) and log(gapminder_2007$lifeExp)

t = 14.752, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.7060729 0.8372165

sample estimates:

cor

0.7800706 # correlation with both variables squared

cor.test(

gapminder_2007$gdpPercap ^ 2,

gapminder_2007$lifeExp ^ 2

)

Pearson's product-moment correlation

data: gapminder_2007$gdpPercap^2 and gapminder_2007$lifeExp^2

t = 8.6437, df = 140, p-value = 1.123e-14

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.4709220 0.6877841

sample estimates:

cor

0.5898894 # correlation with square root of both variable

cor.test(

sqrt(gapminder_2007$gdpPercap),

sqrt(gapminder_2007$lifeExp)

)

Pearson's product-moment correlation

data: sqrt(gapminder_2007$gdpPercap) and sqrt(gapminder_2007$lifeExp)

t = 12.981, df = 140, p-value < 2.2e-16

alternative hypothesis: true correlation is not equal to 0

95 percent confidence interval:

0.6539524 0.8057025

sample estimates:

cor

0.7390648 # grid comparing the 4 transformations

par(mfrow = c(2,2),

mar = c(2,2,2,1))

plot(gapminder_2007$gdpPercap, gapminder_2007$lifeExp, main = "original correlation")

plot(log(gapminder_2007$gdpPercap),log(gapminder_2007$lifeExp), main = "log applied")

plot(gapminder_2007$gdpPercap ^ 2,gapminder_2007$lifeExp ^ 2, main = "data squared")

plot(sqrt(gapminder_2007$gdpPercap),sqrt(gapminder_2007$lifeExp), main = "square root of data")

from scipy.stats import pearsonr

# Define the transformations

gdp_log = np.log(gapminder_2007['gdpPercap'])

gdp_sqrt = np.sqrt(gapminder_2007['gdpPercap'])

gdp_squared = np.square(gapminder_2007['gdpPercap'])

life_log = np.log(gapminder_2007['lifeExp'])

life_sqrt = np.sqrt(gapminder_2007['lifeExp'])

life_squared = np.square(gapminder_2007['lifeExp'])

# correlation with original data

correlation_original, pvalue_original = pearsonr(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'])

print("Correlation with original data:", correlation_original)

print("p-value of correlation with original data:", pvalue_original)

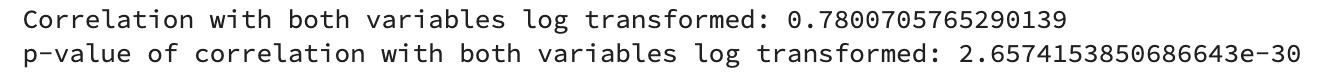

# correlation with both variables log transformed

correlation_log, pvalue_log = pearsonr(gdp_log, life_log)

print("Correlation with both variables log transformed:", correlation_log)

print("p-value of correlation with both variables log transformed:", pvalue_log)

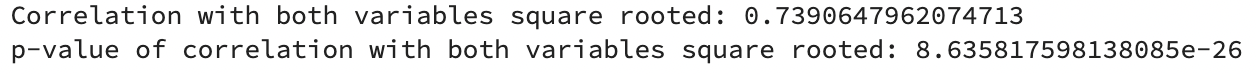

# correlation with both variables square rooted

correlation_sqrt, pvalue_sqrt = pearsonr(gdp_sqrt, life_sqrt)

print("Correlation with both variables square rooted:", correlation_sqrt)

print("p-value of correlation with both variables square rooted:", pvalue_sqrt)

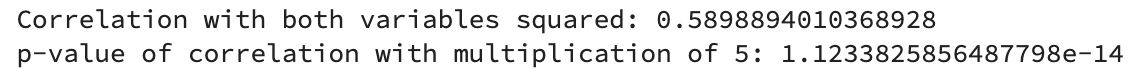

# correlation with both variables squared

correlation_squared, pvalue_squared = pearsonr(gdp_squared, life_squared)

print("Correlation with both variables squared:", correlation_squared)

print("p-value of correlation with multiplication of 5:", pvalue_squared)

# Create a grid of scatter plots

plt.figure(figsize=(12, 6))

plt.subplot(2, 2, 1)

plt.scatter(gapminder_2007['gdpPercap'], gapminder_2007['lifeExp'])

plt.title("Original Correlation")

plt.subplot(2, 2, 2)

plt.scatter(gdp_log, life_log)

plt.title("Log Transformation")

plt.subplot(2, 2, 3)

plt.scatter(gdp_sqrt, life_sqrt)

plt.title("Square Root Transformation")

plt.subplot(2, 2, 4)

plt.scatter(gdp_squared, life_squared)

plt.title("Squared Transformation")

plt.tight_layout()

plt.show()

Whilst this page describes ways to transform the data and how they impact the distributions, this isn’t universally accepted practice as it is changing your data (perhaps similar to arguments that you shouldn’t remove outliers if they reflect real data points). However, transformation does not necessarily bias your data towards or against hypotheses if done appropriately, and is in fact used in mainstream analyses such Spearman’s Rank correlations. There are at least two major possible problems from inappropriately transforming your data:

If it becomes a form of fishing for data through multiple comparisons.

Treating your data unevenly to create meaningless differences between conditions. For example, if you ran a t-test between 2 conditions, but one of them wasn’t normally distributed, then transforming only one of the conditions could make your comparison less meaningful. Let’s use the gapminder data to illustrate this by comparing gdp per capita between Europe and Africa:

spssSkewKurtosis(gapminder_2007$gdpPercap[gapminder_2007$continent == "Europe"]) estimate se zScore

skew -0.1028377 0.4268924 -0.2408985

kurtosis -1.0441533 0.8327456 -1.2538683spssSkewKurtosis((gapminder_2007$gdpPercap[gapminder_2007$continent == "Africa"])) estimate se zScore

skew 1.707376 0.3304137 5.167389

kurtosis 1.793325 0.6500932 2.758566spssSkewKurtosis(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Europe"])

spssSkewKurtosis(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Africa"])

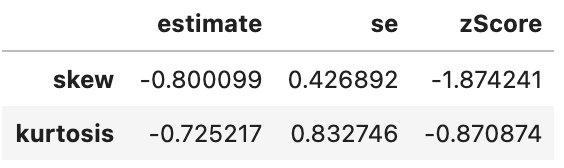

So We can see that there’s a significant problem with skewness for countries from Africa (zScore > 1.96) but not from Europe. The correct thing to do is to apply any transformation (to address skewness) to Africa to Europe also to avoid differences between the groups reflecting bias from the distortions. Logarithmic transformations can help reduce skewness, so let’s see how the means compare after applying the log transformation to both groups:

mean(gapminder_2007$gdpPercap_log[gapminder_2007$continent == "Europe"])[1] 9.985978mean(gapminder_2007$gdpPercap_log[gapminder_2007$continent == "Africa"])[1] 7.486539np.log(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Europe"]).mean()

np.log(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Africa"]).mean()9.9859781300532167.486539235254513There’s a difference, in which Europe had a higher GDP per capita in 2007. Let’s check if both Europe and Africa are less skewed in their distributions after log-transforming their data:

spssSkewKurtosis(gapminder_2007$gdpPercap_log[gapminder_2007$continent == "Europe"]) estimate se zScore

skew -0.7604293 0.4268924 -1.7813138

kurtosis -0.6776747 0.8327456 -0.8137835spssSkewKurtosis(gapminder_2007$gdpPercap_log[gapminder_2007$continent == "Africa"]) estimate se zScore

skew 0.5431380 0.3304137 1.643812

kurtosis -0.6719277 0.6500932 -1.033587spssSkewKurtosis(np.log(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Europe"]))

spssSkewKurtosis(np.log(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Africa"]))

Looking good. Now, what would have happened if we had only log-transformed Africa’s data as it had the skewed distribution:

mean(gapminder_2007$gdpPercap[gapminder_2007$continent == "Europe"])[1] 25054.48mean(gapminder_2007$gdpPercap_log[gapminder_2007$continent == "Africa"])[1] 7.486539gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Europe"].mean()

np.log(gapminder_2007['gdpPercap'].loc[gapminder_2007['continent'] == "Africa"])25054.4816359333387.486539235254513It now looks like Europeans have 3346.604 times as much GDP per capita as Africa!?

The above example hopefully is quite intuitive how problems arise if you apply transformations mindlessly. If you will be comparing differences in magnitudes between conditions, then it is important that transformations are applied equally to avoid bias. If you are correlating between conditions (or conducting a regression), then you do not have the same issue of bias.

Question 1

Which types of transformations might make a distribution normal?

Question 2

Which of the following transformations is least likely to result in a normal distribution?